Need assistance or have a question? Our team is ready to help

We’re increasing our variable home loan interest rates by 0.25% p.a., effective Friday 27 February 2026.

We are currently reviewing our savings and investment rates.

| Chief Executive Officer |

Graham Fryer BEc. CA ANZ GAICD |

| Finance & Administration Manager |

Stephen Allinson BComm, CPA |

| Lending Operations & IT Manager | Michelle Battye |

| Member Services Manager | Ana Ramuta |

| Chair |

Allison R Batten GAICD Allison was appointed Chair of Geelong Bank in October 2023 having served on the Board since 2019. She is currently a member of the Governance Committee and has previously Chaired both the Audit and Risk Committees. Allison is an experienced Board Director & Chair, Executive, and Business Advisor. With a background deeply rooted in the retail sector, she had a successful corporate career with senior executive roles at ASX-listed companies Target Pty Ltd and The Reject Shop Ltd. Since 2014, she has operated a private business consultancy supporting boards, CEOs, and C-Suite executives in delivering a broad range of projects, including strategy development and technology transformation. Allison currently serves as Chair of the AICD Barwon South West Regional Forum and has previously served as an executive board member at Reject Shop Ltd and as a board advisor to NQR Pty Ltd. Allison is a graduate of the AICD Company Directors Course, a graduate of the William & Mary Mason School of Business in strategic planning and management in retail, and a participant in the Senior Executive forum in leadership, strategy, and authenticity at AIM-UWA Business School in WA. A lifelong resident of Geelong and a proud advocate for the region. |

|

Deputy Chair |

Mark Burrowes Mark became a Director in October 2020. He is the Chair of the Governance Committee and a member of the Risk Committee. Mark is a Founding Director of Consigliere Pty Ltd, a family company advisory group. He is also a former Director of several Boards, including the Reach Foundation, the Starlight Children’s Foundation, as well as Managing Director of Medibank Private, Chair of Hardings Hardware and most recently Chair of Scope (Aust) Pty Ltd. He is a Fellow of the Australian Institute of Company Directors. As well as his Board experience Mark has had a 40 year corporate career across the oil sector, banking and finance, health, and retailing. Most recently he has been involved in company turnarounds and he continues to work in the field of Mergers and Acquisitions. He is a resident in the Greater Geelong region. |

| Directors |

Michael J Carroll Michael joined the Board as an Associate Director in 2016, before becoming a full Director in 2017. He is Chair of the Audit Committee. Michael has held a number of senior roles at HCF, GMHBA Limited and business, finance and administration roles with St John of God Health Care and Woodside Petroleum in Melbourne and Perth. Michael is an experienced Finance and Compliance executive with diverse industry experience across the Private Health Insurance, Health, Resources, and Investment

John Connor John joined the Board in 2021 as an observer before becoming a full Director in John has over 20 years' experience in financial services. His specialist areas are banking and insurance with a focus on capital, compliance and risk management. John has a first class Master's Degree in Physics. He is also a Fellow of the Institute of Actuaries Australia (FIAA), a fellow of the Institute Faculty of Actuaries UK (FIA), a Chartered Enterprise Risk Actuary (CERA) and recently completed a graduate

Graham Fryer Graham joined the Geelong Bank Board in 2023 and served as the inaugural Chair of the Treasury Committee. Graham is currently a member of the Treasury Committee and Governance Committee. Graham was appointed Managing Director and CEO of Geelong Bank in July 2025. Graham is an experienced senior finance and operations executive specialising in business improvement, risk management and financial structuring across many industries including Banking and Finance, Higher Education, and Government. He has held CFO and COO roles in major corporations as well as Board and Committee appointments. Graham is a Chartered Accountant and Graduate member of the Australian Institute of Directors, and holds degrees and postgraduate qualifications in Economics, Management and Education.

Theodora Elia-Adams B Comm, CA, MTax, MAICD Theodora joined the Board in 2023 as an observer before becoming a full Director in 2023. She is a member of the Risk, Audit & Treasury Committees. Theodora is an experienced Non-Executive Director, Chair of Audit, Risk and Finance, and a highly accomplished Chartered Accountant and professional services executive having been a Senior Partner at Ernst & Young. She has been Non-Executive Director of ASX listed 4D Medical’s wholly owned subsidiary, ALHI Pty Ltd, and BioMelbourne Network, and is currently a Non-Executive Director at Australian College of Optometry, AUSVEG Ltd, and Building 4.0 CRC. Theodora is known for her strategic thinking and passion for constantly evolving and innovating, and for her ability to draw on both her executive and board experience to offer pertinent insights to strengthen an organisation’s governance posture.

John Velegrinis G Dip Bkg, FFin, MAICD John joined the Board in 2024 as an observer before becoming a full Director in 2024. He is a member of the Risk Committee. John is also a director of Bravery Trust and has over 40 years’ experience in financial services. John’s experience includes a number of senior executive positions at ANZ Banking Group for 30 years in commercial banking, including senior roles in corporate and institutional banking, risk management both domestically and internationally. Most recently John stepped down as CEO of State Trustees Ltd in July 2024 and prior to that CEO of Australian Scholarships Group where he oversaw the strategic transformation of activities to greater client centricity and digital focus for growth. This included significant experience and responsibility for Funds Management with a focus on member and client outcomes. |

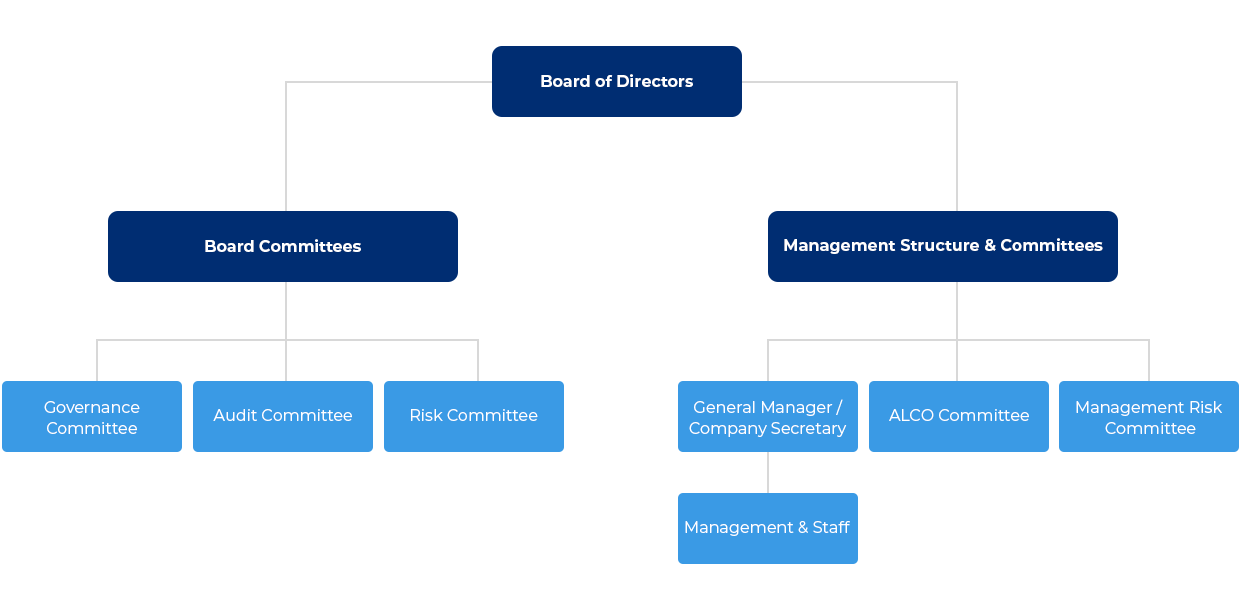

The Board of Directors is responsible for the corporate governance of Geelong Bank. The Board guides and monitors the business and affairs of Geelong Bank on behalf of the members by whom they are elected and to whom they are accountable. An important feature of the Board is to ensure compliance with the prudential and solvency requirements of the Australian Prudential Regulatory Authority (APRA) and the Australian Securities & Investments Commission (ASIC).

The key responsibilities of the Board include:

Directors of Geelong Bank are considered to be independent and free from any business or other relationship that could interfere with, or could be perceived to materially interfere with the exercise of their unfettered and independent judgement.

The Board has established the following committees which operate under a charter approved by the Board.

The purpose of the Governance Committee is to assist the board in the exercise of effective corporate governance, including oversight of Geelong Bank's Governance and Fit & Proper Policies.

The purpose of the Governance Policy is to ensure strong Corporate Governance in the prudent management and financial soundness of Geelong Bank and in maintaining public confidence in the financial system.

The purpose of the Fit & Proper – Responsible Person Policy is to manage the risk to its business or financial standing that persons acting in Responsible Person positions are fit and proper.

The committee has also been appointed by the board to fulfil the role of the Nominations and Remuneration Committees incorporating board renewal, remuneration and nominations.

The Audit Committee will assist the Board in fulfilling its oversight responsibilities and act as an interface between the board and the internal and external auditors. The Audit Committee will review:

The Committee will assist the board in fulfilling its oversight responsibilities and will be responsible for:

The ALCO is a committee responsible for managing the financial assets and liabilities of Geelong Bank. The committee recommends policy, sets strategy and monitors risks related to the management of Geelong Bank's assets and liabilities regarding:

.The Board of Directors has implemented a Risk Management Policy which establishes the overall Risk Management Framework for managing operational risk. Specifically, the Risk Management Policy aims to:

The Board of Directors has overall responsibility for the establishment and oversight of the risk management framework. The Board has established separate Audit and Risk Committees which are responsible for developing and monitoring risk management processes. The committee reports regularly to the Board of Directors on its activities.

Risk management policies and procedures are established to identify and analyse the risks faced by Geelong Bank, to set appropriate risk limits and controls, and to monitor risks and adherence to limits. Risk management processes and systems are reviewed regularly to reflect changes in market conditions and Geelong Bank’s activities.

The Audit and Risk Committees oversee how management monitors compliance with Geelong Bank’s risk management policies and procedures and reviews the adequacy of the risk management framework in relation to the risks faced by Geelong Bank. The Audit and Risk Committees are assisted in its oversight role by Internal Audit. Internal Audit undertakes regular reviews of risk management controls and procedures, the results of which are reported to the Audit & Risk Committees.

Geelong Bank has undertaken the following strategies to minimise risks.

The Bank is not exposed to currency risk, and does not trade in the financial instruments it holds on its books.

The risk of losses from the loans undertaken is primarily reduced by the nature and quality of the security taken. The Board policy is to maintain at least 85% of loans in well secured residential mortgages which carry an 80% Loan to Valuation ratio or less.

The Bank has a concentration in the retail lending for members who comprise employees and family in the Ford Motor Company. This concentration is considered acceptable on the basis that the Bank was formed to service these members, and the employment concentration is not exclusive.

Should members leave the industry the loans continue and other employment opportunities are available to the members to facilitate the repayment of the loans.

The risk of losses from the liquid investments undertaken is reduced by the nature and quality of the independent rating of the investee and the limits to concentration in one entity.

The Board policy is that investments shall be widespread to avoid any undue concentration of risk and all investments must be with financial institutions with a rating in excess of BBB- or higher.

All investments in equity instruments are solely for the benefit of service to Geelong Bank. Geelong Bank invests in entities set up for the provision of services such as IT solutions, treasury services etc where specialisation demands quality staff which is best secured by one entity.

Geelong Bank has set out the maturity profile of the financial assets and financial liabilities, based on the contractual repayment terms.

Geelong Bank is required to maintain at least 9% of total adjusted liabilities as liquid assets capable of being converted to cash within 48 hours under the APRA Prudential standards. Geelong Bank's policy is to apply 15% of funds as liquid assets to maintain adequate funds for meeting member withdrawal requests. The ratio is checked daily. Should the liquidity ratio fall below this level the management and the Board are to address the matter and ensure that the liquid funds are obtained from new deposits and borrowing facilities available.

Operational risk is the risk of direct or indirect loss arising from a wide variety of causes associated with Geelong Bank's processes, personnel, technology and infrastructure, and from external factors other than credit, market and liquidity risk such as those arising from legal and regulatory requirements and generally accepted standards of corporate behaviour.

Geelong Bank’s objective is to manage operational risk so as to balance the avoidance of financial losses and damage to Geelong Bank’s reputation with overall cost effectiveness.