Need assistance or have a question? Our team is ready to help

We’re increasing our variable home loan interest rates by 0.25% p.a., effective Friday 27 February 2026.

We are currently reviewing our savings and investment rates.

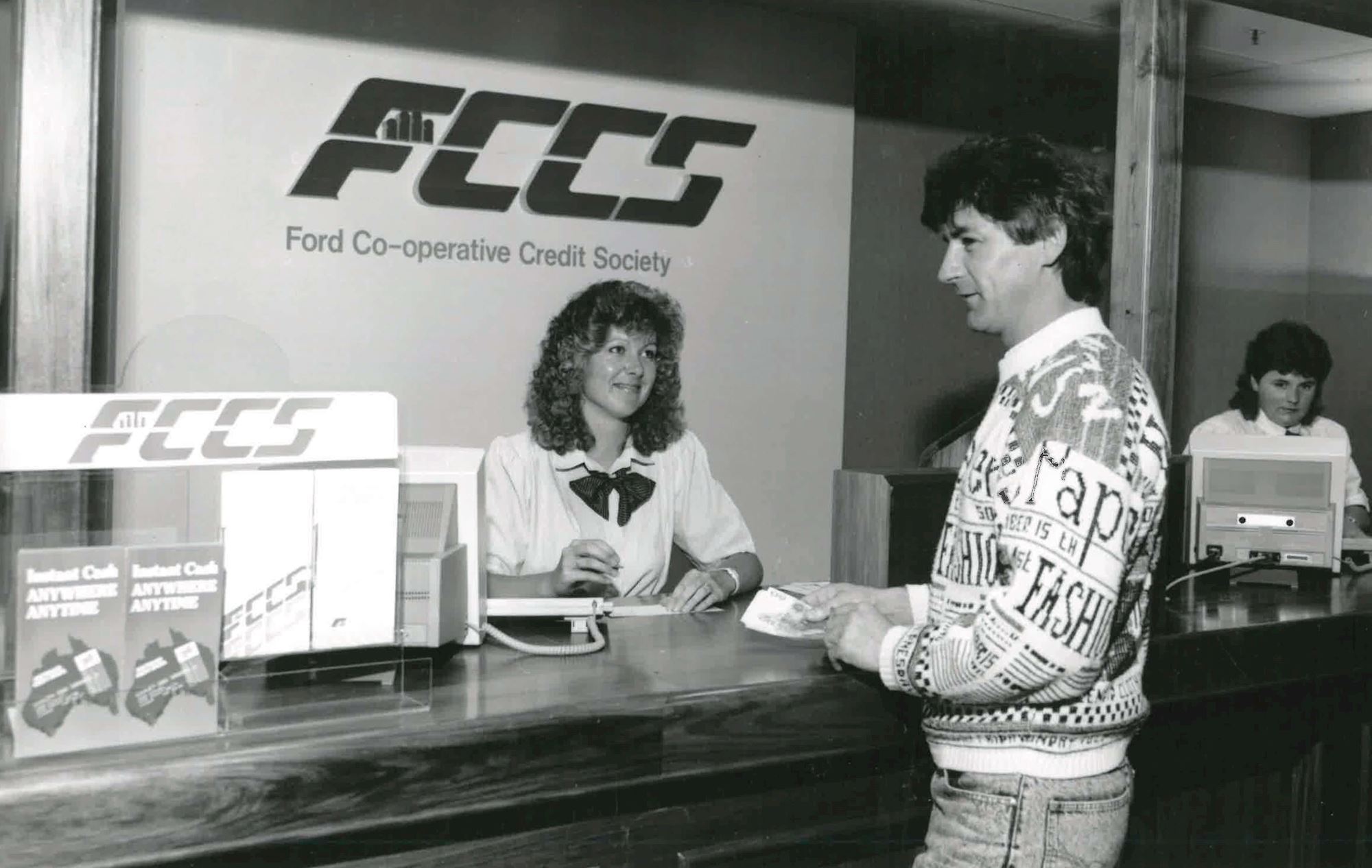

FCCS was born in 1974 within the walls of the Ford Motor Company's Geelong stamping plant. At that time, a group of 80 Ford employees recognized the need for a financial institution that could serve their everyday banking requirements. These employees came together to create something extraordinary—a co-operative that would provide financial lifelines to themselves and their families.

In the late 1970s, FCCS began expanding its services beyond its Geelong Stamping plant origins. At that time, Ford had three major manufacturing plants in Geelong—the casting plant, the engine plant, and the stamping plant. To make banking convenient and accessible for its members, FCCS established agency branches at each of these sites. Later, an additional agency was opened at the product engineering plant. These efforts ensured that Ford employees had easy access to banking services right where they worked, reinforcing FCCS’s commitment to serving its members' financial needs.

The 1980s brought significant growth opportunities to FCCS, including a merger in 1984 with the Ford Broadmeadows Employee Credit Union.

In 1985, the organisation expanded into Sydney, establishing a branch at the Ford Laser factory, marking its first major geographical expansion outside of Victoria.

During 1990 a further merger occurred with a Geelong based Credit Union called Commercial Credit Co-operative Ltd. With this merger our membership was no longer restricted to Ford Employees and their families.

Around 2010, FCCS further embraced innovation by offering off-balance-sheet securitized loans, a service that allowed the credit union to continue providing competitive mortgage options through mortgage brokers.

The closure of Ford’s manufacturing operations in 2016 marked a significant turning point for FCCS. It was a catalyst for change, pushing the credit union to reimagine its future in a rapidly evolving world.

The closure of Ford’s manufacturing was the start of a change in FCCS’s membership base. Members were no longer just Ford employees, and there was a need to ensure the credit union remained relevant to the greater Geelong community.

This led to the rebranding to Geelong Bank in November 2018, shifting from being a traditional credit union to a modern customer-owned banking institution that appeals to the broader community. This transformation ensured that we could continue serving our members while adapting to the evolving financial landscape. The shift also aligned with the Australian government’s legislation allowing co-operatives to use the word "bank" in their names, reflecting the evolution of our services and mission.

As your trusted customer-owned bank, we've been one of Geelong's most passionate supporters for 50 years, watching it grow into the vibrant, dynamic destination it is today.

As Geelong Bank, we're committed as ever in helping you achieve your very best.

We've always had the Geelong community at the very heart of our business. Since 1974, we've put our customers first with personalised, competitive banking that helps you grow. And that will never change.

Click here to view FAQs about our name change.

To be the primary institution meeting the personal financial services needs of our members.

Provide financial products and services that return value to members, workplaces and the local community.